Energy access crowdfunding shows resilience amid shifting macroeconomic conditions: Insights from 'Crowd Power State of the Market Report 2023-2024'

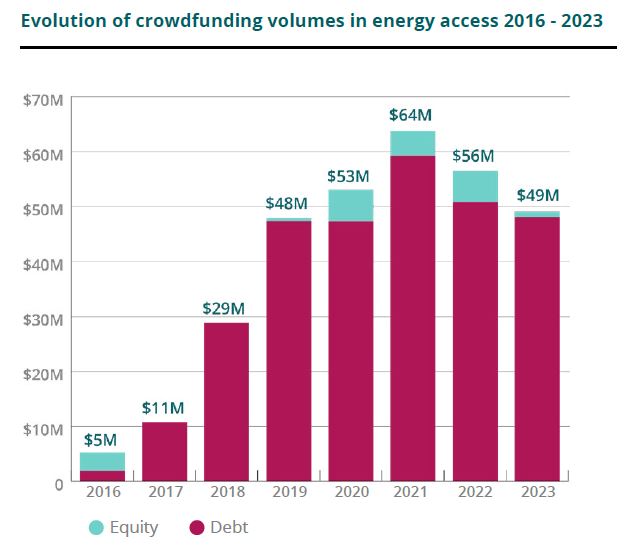

In 2023, the landscape of energy access-related crowdfunding, saw dynamic shifts, yet debt crowdfunding platforms have shown resilience as they expand into other sectors such as commercial and industrial (C&I) scale solar. Overall energy access-related crowdfunding volumes declined 12% in 2023, to $49 million. The decline was predominantly driven by a stark decrease in equity volumes to less than $1 million—a mere fifth of the 2022 levels— amid two campaigns. Debt crowdfunding, on the other hand, has been resilient and stabilised even as macroeconomic conditions create challenges for debt platforms.

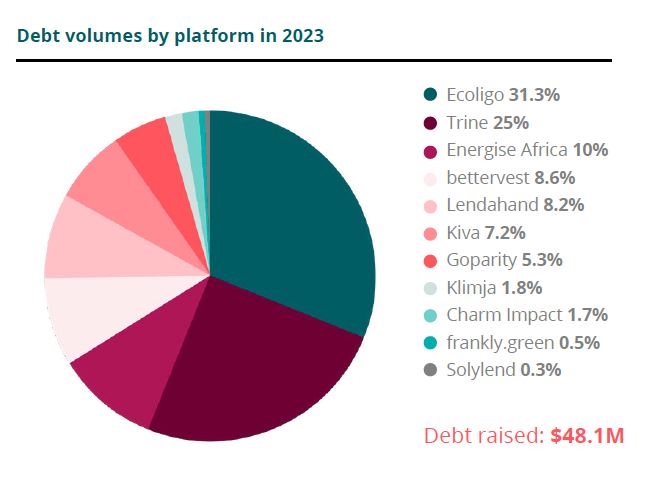

Since 2016, debt crowdfunding has raised over $300 million for energy access projects, averaging $50 million annually over the past five years, with a peak of $59 million in 2021. In 2023, debt crowdfunding volumes sustained the five-year average, raising $48 million, down 5% from the $51 million raised in 2022. The stabilisation of volumes raises pertinent questions of whether debt crowdfunding volumes will plateau. Our analysis suggests that definitive forecasts may still be premature. Whilst stabilising volumes are encouraging, the market appears to be at a critical juncture, with no clear trends emerging across platforms in 2023, as evidenced by the varying performance amongst the 11 debt crowdfunding platforms tracked in the report. Six platforms experienced a drop in volumes, while five saw an increase, highlighting a diverse and dynamic market landscape.

Beyond the nuances of debt crowdfunding platform volumes, the broader market remains highly active, shaped by shifting macroeconomic conditions that directly impact fundraising dynamics. Amid global inflation, local currency volatility, and heightened risk, platforms are struggling to offer attractive risk-adjusted interest rates to investors. These challenges are compounded by exposure to non-performing loans, particularly among borrowers in the solar home system (SHS) sector. As a result, platforms are adapting to these macroeconomic shifts and pivoting their strategies.

A clear example of this adaptation is seen in the evolution of C&I projects. In response to market challenges, some platforms are shifting focus away from SHS company borrowers and increasing their exposure to larger-scale C&I solar projects. In 2023, C&I transaction volumes grew by 14% to $28 million and now account for 59% of debt crowdfunding volumes. C&I projects are attractive to some platforms as C&I offers a different risk profile compared to SHS companies, as off-takers are businesses rather than individuals.

The attractiveness of C&I has pushed debt platforms beyond sub-Saharan Africa and into Southeast Asia and Latin America, where there are more C&I investment opportunities. Three-quarters of C&I loan volumes raised on platforms now originate from projects in Southeast Asia and Latin America, with only $7 million of the total $28 million raised going to projects in sub-Saharan Africa. Some debt platforms view these regions as offering more mature market opportunities with a vast network of small and medium-sized enterprises (SMEs), which are suitable customers for C&I projects, and more stable macroeconomic conditions. Looking forward, the future of energy access-related fundraising appears increasingly tied to C&I projects. We anticipate that C&I loans will continue to dominate the energy access-related debt crowdfunding market due to the larger pipeline of attractive risk-adjusted investment opportunities among C&I borrowers.

In 2023, equity volumes accounted for only 2% of the total energy access-related crowdfunding market, revealing once again the opportunistic nature of equity crowdfunding. It is typically deployed as a one-off fundraiser rather than a sustained strategy.

Another emerging trend in 2023 is platforms seeking to attract larger borrowers in the energy access sector, including C&I companies and larger SHS players, to diversify and risk-balance portfolios for investors. Larger borrowers require significantly more capital than the typical debt crowdfunding borrower, who averaged $587,000 per campaign in 2023. This approach means platforms must simultaneously build their funding capacities. Given current market realities, including a high interest rate environment in Europe, where most platforms are based, platforms are increasingly seeking anchor investors, such as high-net-worth individuals and family offices to efficiently and expeditiously unlock capital.

As this type of capital enters the crowdfunding market, it raises the question: How do we define the crowd? We anticipate the crowd will become more segmented over the coming years, with two distinct investor archetypes emerging – the traditional retail crowd-investor, investing $500 - $1,500 per campaign, and the emerging institutional or ‘sophisticated’ crowd-investor, committing $10,000 or more per campaign. This evolution, combined with shifts in borrower profiles, is likely to reshape the future of debt crowdfunding as the sector navigates towards sustainable growth and resilience amid a dynamic financial landscape.