The impact of Covid-19 on crowdfunding for energy access

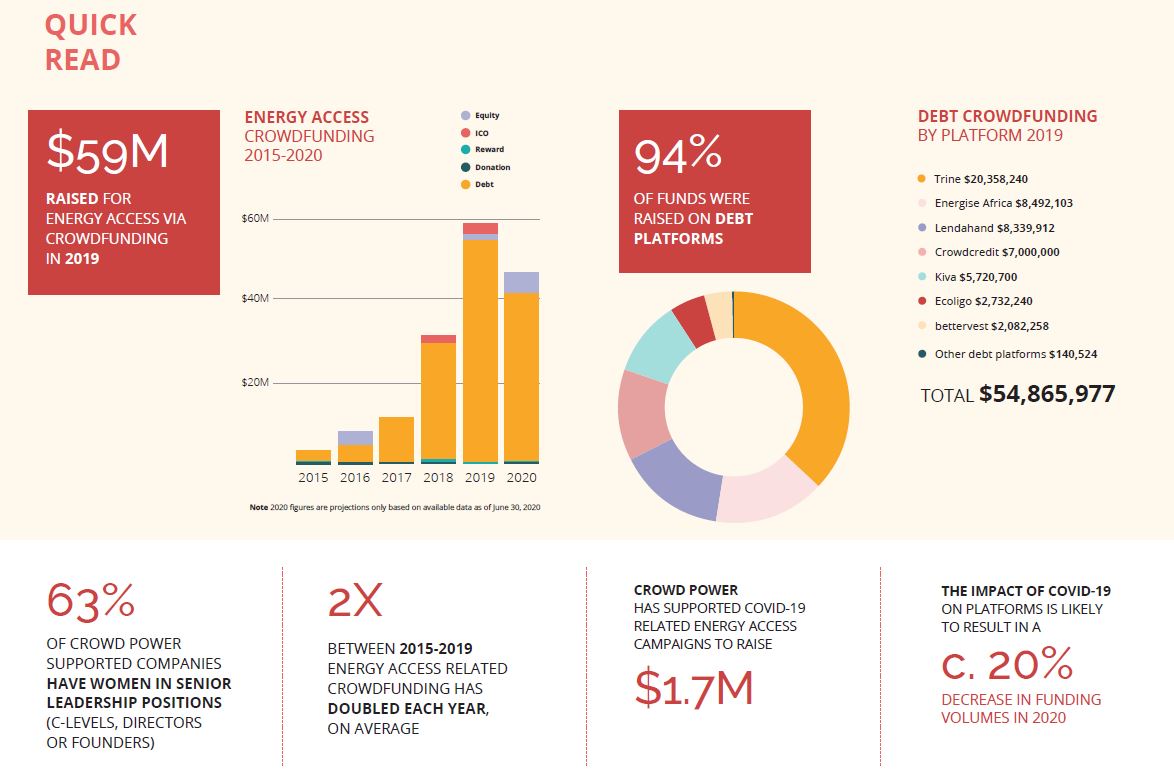

A new report by Energy 4 Impact estimates that crowdfunding related to energy access fell by approximately 20% in 2020 as a result of Covid-19. The report indicates that around $41 million debt was raised for the sector in 2020 in comparison to $55 million in 2019. Debt crowdfunding typically accounts for 92%-95% of all funds raised via crowdfunding in the sector, but in 2020 it accounted for only 87% of funds raised, inclusive of refinancings. The reduction in volume was due to a fundraising pause on several platforms during the second quarter and a cautious approach to taking on new exposure.

The research reveals energy access-related equity crowdfunding surged during 2020 and raised approximately $5 million across six campaigns. It predicts that equity crowdfunding will account for 11% of energy access-related crowdfunding in 2020 up from an average of 1% (2015-2019). UK-based platforms Crowdcube and Seedrs, the main platforms used by the energy access sector, reported record performance in the final half of 2020. The two companies also announced a merger that will result in one dominant UK equity crowdfunding platform from 2021 onwards.

The report Crowd Power: Crowdfunding Energy Access State of the Market 2019-20 comprises part of Energy 4 Impact’s research programme ‘Crowd Power’ (funded through the UK Government’s Transforming Energy Access (TEA) programme) which examines the role of alternative finance, such as crowdfunding, in the energy access sector. Since the third quarter of 2020, Crowd Power has helped to raise close to $2 million with co-funding and platform support, in order to bolster 13 Covid-19 response campaigns.

For example, in mid-2020, Crowd Power supported Kiva’s launch of their crisis loans through their direct lending initiative, which provides low- or no-interest debt to social enterprises. Crisis support loans have been disbursed to clean companies such as Bidhaa Sasa, Biolite, Burn Manufacturing, Deevabits, Simusolar, Solar Sister and Pawame so far. Whilst debt- and equity-providers in the sector have pulled back and other Covid-19 support initiatives have experienced delays, Kiva’s loans have provided a much-needed lifeline.

The Kiva loan has been a game-changer for Kenyan last-mile finance and distribution business Bidhaa Sasa. Co-founder Rocío Pérez Ochoa says,

Without the loan, I doubt we would have been able to recover after the first COVID lockdown. We really appreciate how quickly Kiva was able to act. It took just 3 months from application to disbursement. This is remarkable!

From 2015 to 2019, volumes for energy access-related crowdfunding doubled every year on average. The report provides a detailed analysis of 2019 data, showing Trine ($20.5 million), Energise Africa ($8.5 million) and Lendahand ($8 million) accounting for the majority of crowdfunding activity. Kenya ($11 million), Myanmar ($8.5 million) and Nigeria ($5 million) were the top three countries for debt crowdfunding in 2019.

With such a clear trajectory in recent years, it was assumed that 2020 would be another record-breaking year. Prior to the pandemic, initial analysis predicted energy access-related crowdfunding would raise $119 million in 2020. However, by the middle of 2020, the forecast was revised down to $47 million. Moving into 2021, many questions remain unanswered: will Covid-19 result in high default rates amongst borrowers? When will investing get back to pre-crisis levels? How V-shaped will the recovery be?

While the full extent of Covid-19’s impact on energy access-related crowdfunding and the energy access sector is still unclear, there are promising signs of recovery in the debt crowdfunding market. Many debt platforms that stopped taking on new exposure in the second quarter of 2020 started taking on new exposure to existing borrowers by the third quarter and new exposure to new borrowers by the fourth quarter. Debt platforms have reported high demand from investors with campaigns filling in record time. Energy access-related equity crowdfunding had the most active year since Crowd Power began tracking data in 2015.

Davinia Cogan, Programme Manager, Energy 4 Impact, says:

The analysis within the report contends that reduced debt volumes are largely due to platforms limiting new exposure in order to protect their investor base along with their own business and reputation. Once debt platforms are comfortable with the level of risk associated with increased exposure to both new and existing borrowers in the sector, volumes are expected to pick up again as investor appetite remains intact. The research indicates that disposable incomes for medium- and high-income households in Europe have increased during the pandemic. Anecdotally, there even seems to be an increase in ethical investing, so there is grounds for optimism that 2021 volumes will get back to 2019 funding levels or even higher.

Energy 4 Impact will launch another report showing a detailed breakdown of 2020 data in April 2020.